Must-Consider Online Trading Courses for New Investors in 2025

Explore essential online trading courses for beginners in 2025, covering market basics, risk management, and trading psychology.

Want to start trading but don’t know where to begin? Here’s a quick guide to some of the best online trading courses for 2025, tailored for beginners. These courses cover everything from market basics to risk management and trading psychology, helping you build confidence and skills.

Key Highlights:

- Upskillist: Trading for Beginners – Beginner-friendly, AI tools, lifetime access, 7-day free trial.

- Investopedia Academy: Trading for Beginners – $199, lifetime access, interactive modules, industry-recognized certification.

- Coursera (Yale): Financial Markets – Free or paid options, flexible schedule, foundational knowledge from Yale.

- Udemy: Stock Market Investing Guide – $94.99 (discounted often), beginner-focused, lifetime access.

- Tastytrade: Options Trading Start Guide – Free, options-focused, transparent fee structure.

- Skillshare: Stock Market Core Concepts – Subscription-based, access to multiple courses, hands-on projects.

- Elearnmarkets: Stock Trading 101 – $12.99, 3-year access, practical tools, certification test.

Quick Comparison Table:

| Course Name | Main Topics | Duration | Certification | Price | Special Features |

|---|---|---|---|---|---|

| Upskillist | Market basics, risk management | Self-paced | Digital certificate | 7-day free trial | AI tools, lifetime access |

| Investopedia Academy | Market mechanics, trading strategies | 5+ hours | Digital certificate | $199 | Industry recognition, in-depth tools |

| Coursera (Yale) | Market analysis, financial theory | 6–8 weeks | Digital certificate | Free or paid | Yale curriculum, peer learning |

| Udemy | Technical analysis, trading basics | 8+ hours | Digital certificate | $94.99 (discounted) | Beginner-friendly, regular updates |

| Tastytrade | Options strategies, risk assessment | Self-paced | Digital certificate | Free | Transparent fees, live examples |

| Skillshare | Market essentials, terminology | 4+ hours | Digital certificate | Subscription-based | Hands-on projects, community feedback |

| Elearnmarkets | Market operations, technical analysis | 5+ hours | Digital certificate | $12.99 | 3-year access, practical tools |

Choose a course based on your goals, budget, and learning style. Start with a free trial, set a study schedule, and practice with paper trading to build your skills.

The Ultimate Stock Trading Course (for Beginners)

How to Choose a Trading Course

Picking the right trading course can feel overwhelming, especially with prices ranging from free to nearly $4,000. Here's how to find one that fits your needs.

Course Level and Prerequisites

Start with beginner-friendly courses if you're new to trading. Make sure the course matches your current knowledge and builds gradually, helping you progress step by step.

Teaching Methodology

"The best courses deliver a diverse list of teaching styles, provide training under real-world conditions, offer ongoing access to educational materials, and more".

Look for courses that include a mix of:

- Video lectures and demonstrations

- Interactive activities

- Real-world case studies

- Practice trading simulations

- Downloadable resources for future reference

Risk Management Coverage

A strong focus on risk management is essential. While some courses emphasize personal risk thresholds, others may offer limited strategies. Key topics to look for include:

- Position sizing

- Stop-loss strategies

- Portfolio diversification

- Risk-reward ratios

Schedule Flexibility and Access

Think about how the course fits into your daily routine. Here’s a quick comparison of access types:

| Access Type | Benefits | Typical Cost Range |

|---|---|---|

| Self-paced | Study anytime, lifetime access | $94.99 – $199 |

| Live classes | Real-time interaction, structured learning | $147 – $853/month |

| Hybrid format | Combines self-paced and live elements | $497 – $2,997/year |

Certification Value

If you're planning a career in financial services, a course that offers industry-recognized certification can add credibility to your resume.

Cost Considerations

Course prices vary significantly. Keep in mind, a higher price doesn’t always mean better content. Some platforms even offer free resources for beginners to get started.

Platform Reputation

The reputation of the course provider matters. Look for platforms with:

- A proven history in financial education

- Instructors with real trading experience

- Regular updates to reflect current market trends

- Positive reviews and testimonials from past students

"Financial markets are inherently complex and evolve continuously. Successfully navigating them requires traders of all levels to be willing and eager to learn new concepts, apply new strategies, and adjust to the latest market conditions".

These factors will help you identify the best trading courses available today.

1. Upskillist: Trading for Beginners

Upskillist offers a beginner-friendly course designed to teach new investors the basics of trading. It’s a practical starting point for anyone looking to understand market fundamentals and develop trading skills.

Course Structure

The course follows a step-by-step approach, building knowledge through interactive online classes. Key topics include:

- Market analysis basics

- Common trading terms

- How to read charts

- Risk management strategies

- Introduction to trading psychology

Learning Experience

This program focuses on hands-on learning. Students engage in interactive sessions, analyze real-time market data, and complete assessments. AI tools like Compass AI and Pathfinder are integrated to enhance the learning process.

Certification Value

Graduates receive a globally recognized certification that confirms their understanding of trading fundamentals. This certification can help demonstrate dedication to professional growth, especially for those pursuing careers in finance. The course also offers flexible study options to accommodate different schedules.

Accessibility and Flexibility

| Feature | Benefit |

|---|---|

| Flexible scheduling | Study at your own pace |

| 7-day free trial | Explore the course risk-free |

| Lifetime access | Revisit materials anytime |

| Mobile compatibility | Learn on any device |

Students also benefit from expert updates, personalized learning paths, progress tracking, and interactive Q&A sessions, making the learning process smoother and more engaging.

The course content is frequently updated to reflect current market trends and trading practices, ensuring students gain up-to-date knowledge and skills.

Getting Started

New students can start with a 7-day free trial, which gives full access to all course materials and AI tools. This trial period lets learners explore the platform and decide if the teaching style suits their needs before committing.

2. Investopedia Academy: Trading for Beginners Program

After exploring Upskillist, let’s dive into another beginner-friendly option.

Investopedia Academy's Trading for Beginners Program introduces the basics of trading and explains how markets work through engaging and interactive modules.

Course Content

This program covers key topics like market analysis, creating strategies, different market types, trading psychology, and managing trades.

Learning Resources

A variety of learning tools are used to simplify complex concepts:

| Resource Type | Description |

|---|---|

| Video Lessons | Explains trading concepts clearly |

| Interactive Content | Practice with real-world scenarios |

| Assessment Quizzes | Tests understanding after each module |

| Technical Analysis | Focuses on charts and patterns |

Practical Application

Students can apply what they learn with a 30-day free trial on the All-Star Charts platform. This hands-on experience is a great way for beginners to gain confidence and practical trading skills.

Cost and Features

The program costs $199 and includes lifetime access to all materials. It offers interactive modules, quizzes, technical tools, and progress tracking, making it a comprehensive package.

Course Structure and Experience

Starting with trading basics, the course gradually moves into advanced topics like market analysis and strategy building. The combination of videos, interactive lessons, and quizzes ensures learners not only understand the theory but also prepare for the mental challenges of trading.

3. Coursera: Financial Markets (Yale)

Yale University's Financial Markets course on Coursera is a highly-rated introduction for beginners, boasting a 4.8/5 rating from over 30,000 reviews.

Course Overview

This course is tailored for those new to investing, offering insights into areas like investment banking, risk management, and financial regulations. With a flexible schedule, it can be completed in 1–3 months, making it a great fit for busy professionals. It’s an ideal starting point for building foundational knowledge in financial markets.

Core Topics

The course covers several key areas:

| Topic Area | What You’ll Learn |

|---|---|

| Investment Banking | How markets operate and the role of institutions |

| Risk Management | Identifying and managing risks in trading |

| Behavioral Economics | Psychological factors influencing market behavior |

| Securities & Derivatives | Basics of trading instruments |

| Capital Markets | Market structure and dynamics |

Learning Focus

The program combines theory with practical application, emphasizing:

- Financial market basics

- Corporate finance principles

- Strategic decision-making in trading

Access and Certification

- Free access: View all course materials without charge

- Paid option: Includes graded assignments and a verified certificate

- Financial aid: Available for eligible learners

Skill Development

This course equips beginners with skills like:

- Analyzing financial policies

- Assessing business risks

- Making informed investment decisions

It’s a great way to kickstart a trading career or deepen investment knowledge in today’s fast-changing financial landscape.

4. Udemy: Stock Market Investing Guide

Udemy offers a course designed to teach the essentials of stock market investing through on-demand video lessons. This self-paced program is perfect for beginners who want to grasp the basics while enjoying lifetime access to course materials and updates.

What the Course Covers

- Market Foundations: Learn stock market basics and key terminology.

- Technical Analysis: Understand how to read charts and identify trends.

- Risk Management: Explore strategies to diversify and manage investment risks.

- Trading Psychology: Develop disciplined habits for smarter trading decisions.

Available Learning Tools

- Engaging video lectures

- Downloadable materials

- Interactive exercises

- Access across multiple devices

- Certificate of completion

The course also encourages students to put their knowledge into practice through real-time market analysis, portfolio creation, and risk management strategies.

Cost and Benefits

This program is available for a one-time fee, often with promotional discounts. Plus, it includes a money-back guarantee, making it a low-risk option for anyone looking to build a solid foundation in stock market investing.

5. Tastytrade: Options Trading Start Guide

Tastytrade's Options Trading Start Guide is designed with beginners in mind, offering a straightforward fee structure. The platform charges a commission to open options trades but does not charge fees to close them, making trading more budget-friendly.

Here’s a breakdown of the fees for opening options positions:

| Contract Type | Opening Commission | Maximum Fee |

|---|---|---|

| Stock & ETF Options | $1.00 per contract | $10 per leg |

| Broad-Based Index Options | $1.00 per contract | No maximum |

| Futures Options | $2.50 per contract | No maximum |

| Micro Futures Options | $1.50 per contract | No maximum |

This fee structure makes it easier for new traders to understand and manage their costs while exploring options trading. It aligns well with the guide’s focus on making the trading process approachable and transparent.

6. Skillshare: Stock Market Core Concepts

Skillshare takes a membership-based approach to learning. Their Stock Market Core Concepts course is available through gift memberships, which come in three durations: 3, 6, or 12 months. This course is part of Skillshare's online learning community.

| Membership Duration | Access |

|---|---|

| 3 Months | Full course access |

| 6 Months | Full course access |

| 12 Months | Full course access |

With a membership, you not only get access to this course but also thousands of other classes. It's a great way for beginners to dive into trading while exploring a variety of topics at their own pace.

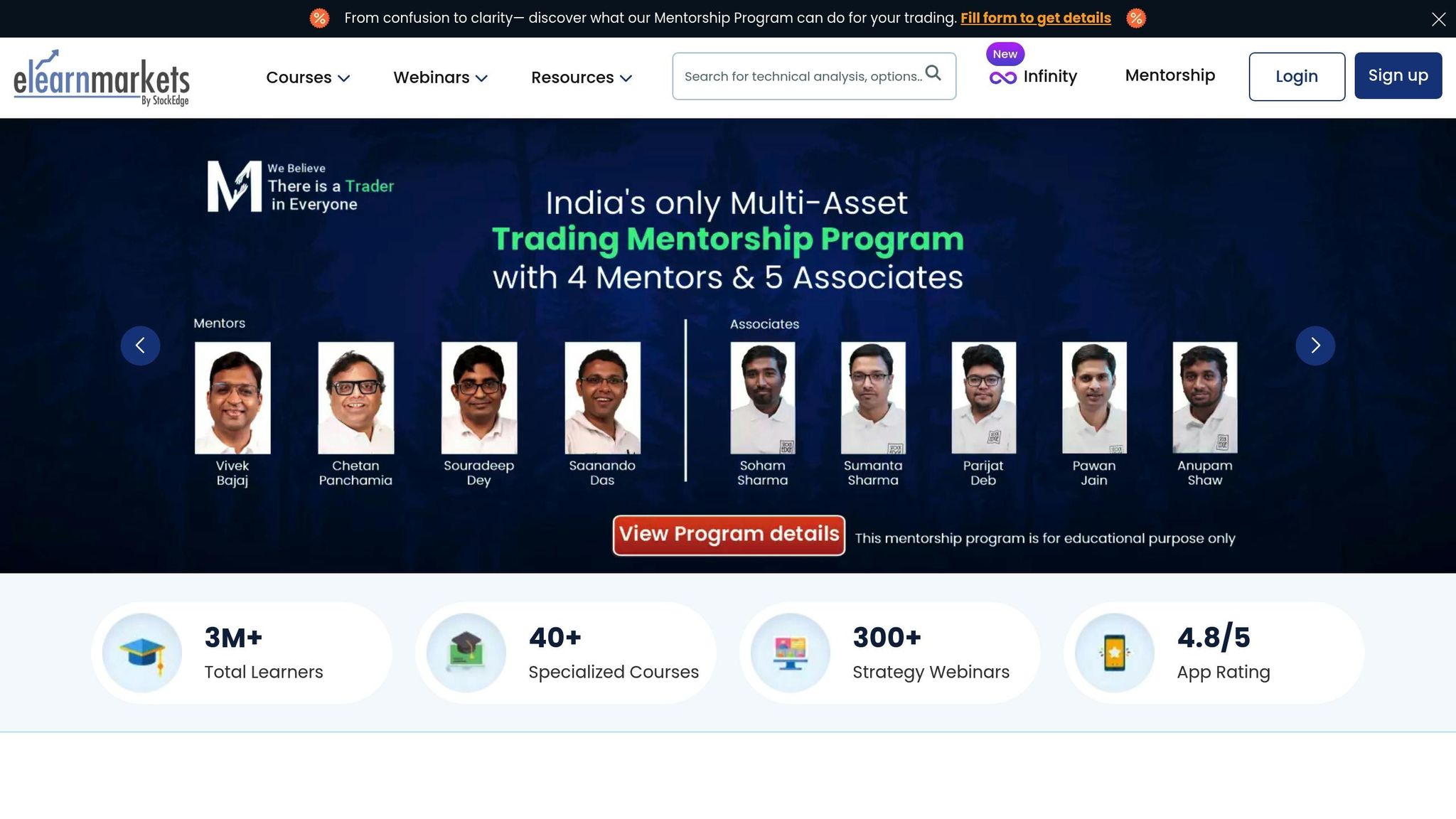

7. Elearnmarkets: Stock Trading 101

Elearnmarkets' "Stock Market Made Easy" course provides the fundamentals of trading through recorded lessons and text-based modules. With over 327,000 learners enrolled and a 4.4 rating, it focuses on practical skills using real-world tools.

The course incorporates platforms like the NSE website and Live Terminal for hands-on learning. It includes over 5 hours of video lessons and 4 text modules, presented in various formats.

| Course Component | Details |

|---|---|

| Video Content | 5+ hours |

| Text Materials | 4+ modules |

| Course Validity | 3 years |

| Certification Test | 40 minutes (60% passing score) |

| Current Price | $12.99 (approximately) |

| With Infinity Plan | Free* (Infinity Plan: ~$64.99/year, discounted from ~$130/year) |

*The course is included at no additional cost with an Infinity Plan subscription.

The curriculum is structured to cover essential market concepts, including:

- How financial markets operate

- Key players in capital markets

- IPO procedures

- Trading terminology

- Corporate actions

- Basics of mutual funds and SIPs

- Introduction to fundamental and technical analysis

In January 2025, student Nishant Kumar S praised the course for its clarity on settlement processes, corporate actions, market timings, analysis methods, economic policies, and exchange operations, highlighting its practical approach.

Learners who pass the 40-minute certification test with at least 60% receive a certificate confirming their trading knowledge. Course materials remain accessible for three years after enrollment, offering a reliable resource for ongoing learning.

Course Features at a Glance

Here's a quick comparison of key features from various trading courses to help you find the best match for your needs.

| Course Name | Main Topics | Duration | Certification | Price | Special Features |

|---|---|---|---|---|---|

| Upskillist: Trading for Beginners | • Market fundamentals • Basic trading strategies • Risk management |

Self-paced | Digital certificate | 7-day free trial | AI tools, lifetime access, expert-led instruction |

| Investopedia Academy: Stock Market Basics | • Market mechanics • Investment principles • Portfolio management |

5+ hours | Digital certificate | $199 | Industry recognition, in-depth resources |

| Coursera: Financial Markets (Yale) | • Market analysis • Financial theory • Investment strategies |

6-8 weeks | Digital certificate | Variable | Yale curriculum, professor-led, peer learning |

| Udemy: Stock Market Investing Guide | • Market fundamentals • Technical analysis • Trading basics |

8+ hours | Digital certificate | $94.99 (often discounted) | Beginner-friendly, video lessons, regular updates |

| Tastytrade: Options Trading Start Guide | • Options basics • Strategy development • Risk assessment |

Self-paced | Digital certificate | Free | Live examples, market updates, community access |

| Skillshare: Stock Market Core Concepts | • Market essentials • Trading terminology • Basic analysis |

4+ hours | Digital certificate | Monthly subscription | Hands-on projects, community feedback, exercises |

| Elearnmarkets: Stock Trading 101 | • Market operations • Technical analysis • Trading fundamentals |

5+ hours | Digital certificate | $12.99 | 3-year access, practical tools |

Consider your schedule and learning preferences when choosing a course. Take advantage of trial periods and discounts to explore the content before committing. Use this comparison to identify the course that aligns best with your goals and dive deeper into trading education in the next section.

Next Steps

Ready to take your trading education further? Here’s how you can move forward effectively:

-

Choose Your Trading Style

Decide if you’re interested in day trading, swing trading, or long-term investing. This will help you select courses that match your goals. -

Evaluate Your Budget and Time

Consider how much time and money you can commit. While some premium courses come with a higher price, there are plenty of affordable options that provide solid foundational knowledge. -

Get the Most Out of Your Learning

To make the most of your course:- Start with a free trial if available, to test the teaching style.

- Set aside dedicated time for studying.

- Take thorough notes and practice using paper trading.

- Join online communities to connect with other learners.

Practical Steps to Get Started

1. Begin with Core Concepts

Start by mastering the basics - understand how markets work and familiarize yourself with key trading terms. This will set the stage for more advanced strategies.

2. Set Up Your Study Space

Find a quiet, organized area for studying. Make sure you have everything you need, including a reliable internet connection for live sessions.

3. Plan Your Study Timeline

Break down your learning into manageable steps:

- Weeks 1-2: Focus on market fundamentals.

- Weeks 3-4: Dive into the basics of technical analysis.

- Weeks 5-6: Learn about risk management strategies.

- Weeks 7-8: Put your knowledge into practice with paper trading.

Trading education is a continuous process. Start with a free trial to explore the fundamentals, and build confidence with expert-led, hands-on learning.