Top Stock Market Courses to Become an Expert Investor in 2025

Explore top stock market courses to enhance your investing skills in 2025, catering to all levels from beginners to advanced traders.

Want to master stock market investing in 2025? Here’s a quick guide to the best courses available, tailored to your learning style and investment goals. Whether you're a beginner or advanced investor, these programs cover everything from market basics to advanced trading strategies.

Highlights:

- Upskillist Stock Market Mastery: Beginner-friendly, 16-week program with CPD accreditation.

- Coursera: Financial Markets by Yale: Academic insights, 10-hour course, free to audit.

- Udemy: Stock Market Investing for Beginners: Affordable, beginner-focused, 12 hours of video content.

- Investopedia Academy: Advanced trading modules, self-paced, $199 per course.

- edX NYIF Professional Certificate: Intermediate to advanced, 9-hour program, $239.20.

- Skillshare: Stock Market Fundamentals: Beginner-friendly, 10+ hours, subscription-based.

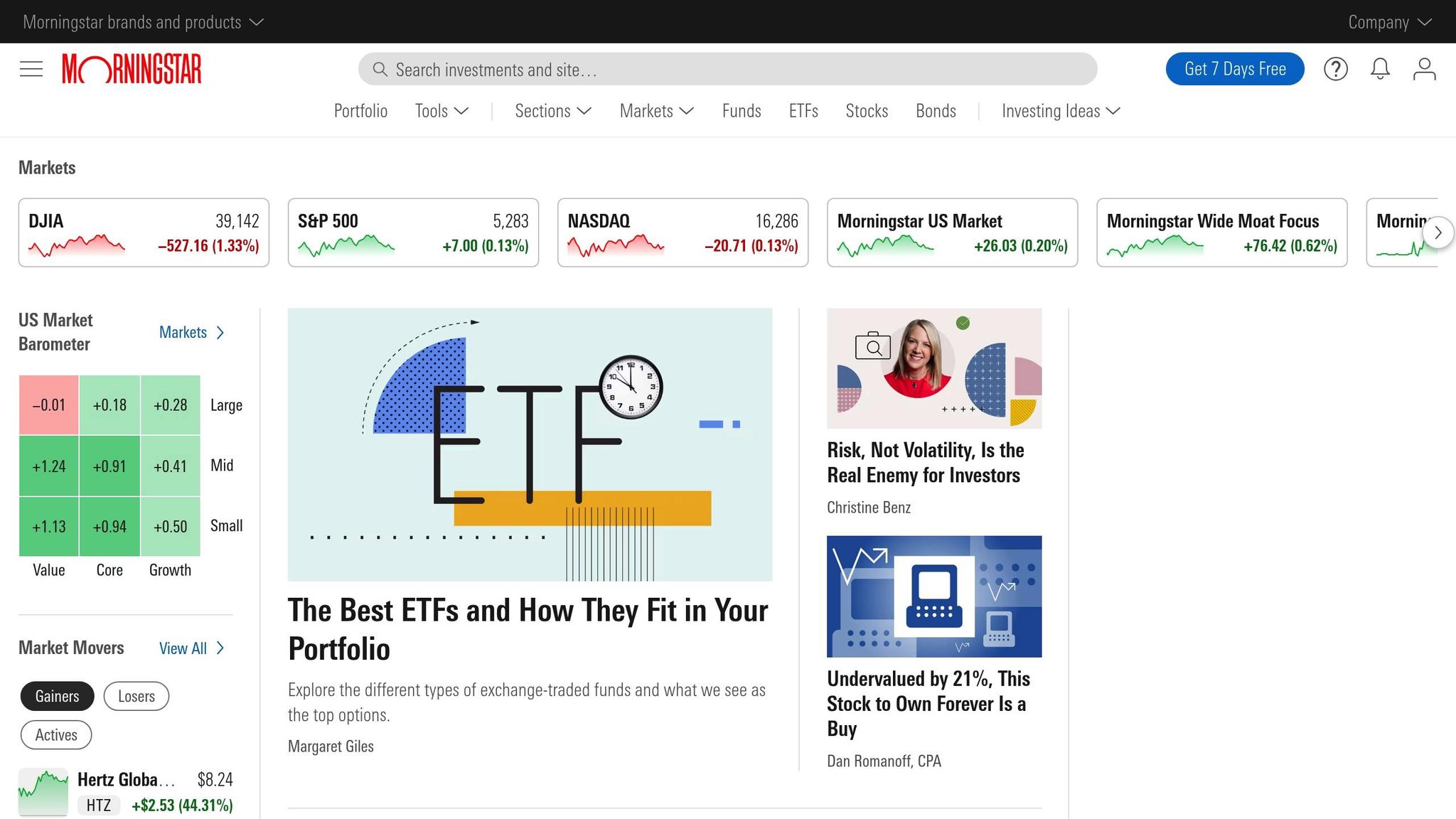

- Morningstar: Investing Classroom: Free, short lessons for foundational knowledge.

Quick Comparison:

| Course Name | Skill Level | Format | Duration | Price |

|---|---|---|---|---|

| Upskillist Stock Market Mastery | Beginner to Intermediate | Interactive Online Classes | 16 weeks | Free trial, subscription |

| Coursera: Financial Markets | Intermediate | Video Lectures, Quizzes | 10 hours | Free to audit, extra for certificate |

| Udemy: Stock Market Investing | Beginner | Video Content | 12 hours | $94.99 (discounts often) |

| Investopedia Academy | All Levels | Videos, Quizzes | Self-paced | $199 per module |

| edX NYIF Professional Certificate | Intermediate to Advanced | Video, Simulations | 9 hours | $239.20 |

| Skillshare: Stock Market Fundamentals | Beginner | Video Lessons | 10+ hours | Subscription |

| Morningstar: Investing Classroom | Beginner to Intermediate | Self-paced Modules | 10 min/lesson | Free with library card |

Key Takeaway:

Pick a course that matches your skill level and trading style. From free resources to in-depth programs, these courses offer tools to sharpen your investing skills in a dynamic market.

How to Invest in Stocks For Beginners in 2025 (Full Course)

Key Elements of Stock Market Courses

When choosing a stock market course, there are several essential factors to consider. These elements can help you identify courses that offer genuine value and equip you with the knowledge needed to invest effectively.

Foundational Market Knowledge

A good course explains the basics of how the stock market works, including key terms, market mechanics, and the roles of participants.

Technical and Fundamental Analysis

Both analysis methods are crucial for making informed investment decisions. Look for courses that teach you how to:

- Analyze company financials and market indicators

- Interpret price charts

- Recognize market trends

- Use forecasting techniques effectively

Risk Management Framework

Risk management is a key part of any investment strategy. Courses should offer practical tools and strategies like asset allocation and diversification to help you manage and reduce risk.

Trading Psychology

Investing isn't just about numbers - mindset matters too. A solid course will address topics like emotional control, decision-making under pressure, and maintaining discipline.

Practical Application Tools

Hands-on learning is invaluable. Look for courses that include tools like market simulations, access to real-time trading platforms, and integrated charting or news resources.

Learning Format and Accessibility

The best courses cater to different learning styles by offering a mix of teaching methods, such as videos, written materials, and interactive sessions.

Investment Strategy Development

Courses should guide you in creating a strategy that aligns with your risk tolerance, financial goals, timeline, and available capital.

Continuous Learning Resources

A quality course doesn’t stop at the basics. Look for resources like:

- Regular updates to course content

- Access to current market analysis

- Community forums for peer discussions

- Extra learning materials

- Updates on market trends

Use these criteria to evaluate stock market courses and find one that suits your investment goals.

1. Upskillist Stock Market Mastery

Upskillist offers a 16-week program designed to help beginners gain confidence in stock trading. The course covers essential topics like market basics, analysis techniques, risk management, and trading psychology. It’s broken into four levels: Diploma (market fundamentals), Intermediate (financial analysis), Advanced (technical patterns), and Proficient, which introduces the "Find, Confirm, Trade" (F.C.T) strategy. The program is CPD-accredited and allows students to learn at their own pace.

Key Features: CPD accreditation, 32 lessons, the F.C.T strategy, and a flexible 16-week schedule.

Who Should Enroll

- Individuals new to trading who want a structured, practical approach to learning.

- Aspiring investors looking to build a strong foundation and trading skills.

This course combines theory with practical exercises, preparing participants for professional-level trading in today’s fast-changing market.

Next: Coursera's Financial Markets by Yale University provides insights from a leading academic institution.

Based on Upskillist course overview and CPD Certification Service details.

2. Coursera: Financial Markets by Yale University

Yale University's Financial Markets course on Coursera offers a solid foundation in understanding market operations, combining academic insights with practical examples to help investors navigate the challenges of 2025.

Course Overview

This course runs for 10 hours and is divided into four modules that focus on key financial market topics. It boasts an impressive average rating of 4.7/5 from 1,361 reviews. Upon finishing, participants receive a shareable certificate to showcase their knowledge.

Topics include:

- The workings of the banking and securities industries

- Principles of managing financial risk

- Stock and bond market fundamentals

- Portfolio management techniques

- Analysis of emerging markets

- Behavioral economics insights

What You'll Gain

This course blends theory with practical applications, helping students build actionable skills:

- Assess risk factors and track stock performance over time

- Understand hedge fund operations and portfolio management strategies

- Analyze financial statements and interpret key ratios

- Suitable for beginners while offering depth for advanced learners

Quick Stats

- Completion Time: 10 hours

- Learner Satisfaction: 97%

- 5-Star Ratings: 72.81%

Up next: Learn about Udemy's Stock Market Investing for Beginners course.

Based on verified Coursera course reviews.

3. Udemy: Stock Market Investing for Beginners

Udemy offers a beginner-friendly course on stock market investing, taught by John Doukasse. It's designed to provide a solid foundation for those new to the world of investing.

Course Overview

John Doukasse's Stock Market Investing for Beginners has attracted over 400,000 students and holds an impressive 4.5/5 rating. The course dives into key topics like market basics, investment strategies, risk management, and portfolio building.

Highlights of the course include:

- 4.5/5 rating from 31,742 reviews

- Certificate of completion

- Quizzes at the end of each module

- Designed for beginners

- Instructor rating: 4.6/5

What You'll Learn

This course aims to equip you with the skills to:

- Understand stock market fundamentals and key terms

- Develop reliable investment strategies

- Use risk management techniques effectively

- Construct and manage a well-rounded portfolio

Student Feedback

"The perfect introduction to stocks and a must for anyone starting out", says Benjamin Estrada Murguia.

Joseph Ezeala shares, "It gave me the confidence to move forward in stock trading".

Next: Take your skills further with Investopedia Academy's Become a Day Trader.

4. Investopedia Academy: Become a Day Trader

Investopedia Academy offers a hands-on approach for those looking to sharpen their trading skills. Their Day Trader track is designed to enhance your technical abilities with a mix of video lessons, exercises, and quizzes - all taught by industry professionals. Upon completing a course, you'll receive a certificate. The platform features over 40 self-paced courses and access to past webinars.

The Technical Analysis Track includes the following modules, each priced at $199:

- Trading for Beginners: Covers the basics of trading.

- Technical Analysis: Focuses on using indicators effectively.

- Advanced Technical Analysis: Explores intra-day trading strategies.

Beyond these, Investopedia Academy provides specialized courses to hone specific strategies:

- Options Trading for Beginners

- Advanced Options Trading: Taught by former Wall Street trader David Green.

- Cryptocurrency Trading: Techniques for trading major and alternative coins.

- Forex Trading for Beginners: Essential skills for navigating the FX market.

- Algorithmic Trading Basics: Learn to implement automated strategies.

Each course costs $199 and includes lifetime access to all materials, making it a well-structured path from fundamental analysis to practical trading tactics.

Next up: edX's Professional Certificate in Stock Trading by NYIF.

5. edX: Professional Certificate in Stock Trading by NYIF

The Professional Certificate in Stock Trading from NYIF is a 9-hour program led by Wall Street experts Peter Tuchman and David Green. This course combines theory with practical strategies across eight modules, covering topics like market terminology, money management, swing trading, and options.

Priced at $239.20 (discounted from $299), the course requires participants to complete all modules and pass a 20-question, 60-minute exam with a minimum score of 70%. If needed, the exam can be retaken for $99. The program includes realistic trading simulations and grants students five days of access to David Green's live trading room. To enroll, participants must first complete NYIF’s Intro to Stock Trading Technical Analysis and The Skill of Day Trading certificates. This course is designed to help traders effectively use technical analysis and manage risk in dynamic markets.

Next up: Skillshare’s Stock Market Fundamentals offers beginner-friendly lessons on investing basics.

6. Skillshare: Stock Market Fundamentals

Zac Hartley's Stock Market Fundamentals course on Skillshare offers over 10 hours of beginner-friendly content. It dives into market history, stocks, bonds, indices, as well as technical and fundamental analysis.

The course teaches key skills like reading charts, identifying trend lines and patterns, analyzing volume, and using indicators such as moving averages, MACD, and RSI. Students also learn how to evaluate companies using financial statements and ratios.

On the practical side, the course covers portfolio diversification, stop-loss strategies, and the basics of ETFs, mutual funds, day trading, and options. Hands-on activities include chart setup and trade execution. One standout case study showcases a 44% gain in less than 10 days.

Next, we'll look at Morningstar's Investing Classroom, which provides a flexible, self-paced way to build core investing skills.

7. Morningstar: Investing Classroom

Morningstar's Investing Classroom is perfect for those looking to learn about investing without spending a dime. It offers over 100 short courses covering topics like stocks, mutual funds, and portfolio building. Each course takes about 10 minutes to complete and wraps up with a quiz to help solidify the material.

These lessons are great for improving your investment strategies, and many public libraries in the U.S. provide free access to them for library cardholders. This on-demand access makes it easier to get started without the need for paid courses.

Next: Compare key course features at a glance.

Course Features at a Glance

Here’s a quick comparison of stock market courses to help you find the right fit for your goals and preferences.

| Course Name | Skill Level | Format | Duration | Price Range |

|---|---|---|---|---|

| Upskillist Stock Market Mastery | Beginner to Intermediate | Interactive Online Classes | 16 weeks | 7-day free trial, then subscription |

| Coursera: Financial Markets | Intermediate | Video Lectures, Quizzes | 10 hours | Free to audit, Certificate track extra |

| Udemy: Stock Market Investing | Beginner | Video Content | 12 hours | $94.99 (frequent discounts) |

| Investopedia Academy: Day Trader | All Levels | Videos, Quizzes, Interactive | Self-paced | $199 per module |

| edX: NYIF Professional Certificate | Intermediate to Advanced | Video, Simulations | 9 hours | $239.20 |

| Skillshare: Stock Market Fundamentals | Beginner | Video Lessons | 10+ hours | Monthly subscription |

| Morningstar: Investing Classroom | Beginner to Intermediate | Self-paced Modules | 10 min/lesson | Free with library card |

Key Factors to Consider

- Instruction Style: Decide between flexible self-paced courses or structured live classes.

- Access Period: Check if the course offers lifetime access or is limited to a specific timeframe.

- Additional Support: Look for features like community forums, mentor assistance, or hands-on practice tools.

- Certification: Evaluate the value and recognition of the certificate provided.

Use this table and tips to narrow down the options that align with your learning style and investment goals.

Next: Matching Courses to Your Investment Style

Matching Courses to Your Investment Style

Here's a guide to help align course features with your trading approach.

For long-term investors, Upskillist offers a program that emphasizes the basics of investing, portfolio diversification strategies, and risk management frameworks. The curriculum blends technical and fundamental analysis with risk management principles, delivered through interactive classes and AI-driven tools.

Different trading styles call for specific expertise. Active traders often prioritize technical analysis and advanced risk management, while long-term investors focus on building portfolios and understanding market fundamentals. If your interests lie in options, cryptocurrency, or forex, look for courses that address those areas alongside traditional stock trading concepts.

Up next, we’ll summarize the key points to help you select the right course.

Conclusion

You've matched course features with your investing style - now it's time to solidify your plan with some final thoughts.

By 2025, nearly half of professionals will need to learn new skills to stay competitive. Online stock market courses provide the tools you need - whether it's mastering fundamental analysis or tackling advanced trading strategies - to confidently handle market fluctuations.

Course costs can vary widely, from under $100 for beginner-level content to several thousand dollars for in-depth, advanced programs. Many courses even include lifetime access to materials. Think of these fees as an investment in your financial knowledge and future.

To succeed, pick a course that matches your investment approach and learning style. Look for programs that emphasize:

- Real-World Practice: Hands-on experience with real-market scenarios

- Strong Support: Continued access to learning resources

Find a course that aligns with your goals, dedicate yourself to practice, and grow your investing expertise in the years to come.